HOME OWNERSHIP – IT’S A BIG DECISION

Congratulations!!

Buying your first home is a massive milestone. It has a lot of positives, and also a lot of responsibilities, it’s very important that you are ready to take this big step both financially and from lifestyle perspective. To help you make the right decision, we have outlined some of the key issues to consider when buying your first home.

IF YOU DECIDE TO BUY

Purchasing your first home is such an exciting step. It seems like a complex process, especially when it’s your first time, but rest assured there is plenty of help and support available for you from your Mortgage Broker through the process, and the result is worth it. A well-chosen property should rise in value over time while the balance of your home loan will reduce as you make principle repayments. Hard to imagine at the moment, but one day your home will be paid off completely and you can enjoy a life without a mortgage or paying rent.

SAVING A DEPOSIT

Now that you are ready to begin looking for your first home, the key starting point is knowing how much you can afford to pay in loan repayments a month. This will help determine the loan amount you can have and therefore the type of property you can afford to buy. This is where the size of your purchase deposit is very important.

100% LOANS TYPICALLY NO LONGER EXIST

Generally, it’s no longer possible to get a loan for the whole of a property’s purchase price. Most lenders will want you to put down at least 5% of the purchase price of the property. The rest may be financed using the home loan.

A LARGER DEPOSIT MAY MEAN A LOWER INTEREST RATE

The larger your purchase deposit, the less risk you represent to the lenders. This also puts you in a better position to negotiate a lower interest rate.

LENDERS MORTGAGE INSURANCE

If you can put a deposit of 20% or more, you can often avoid paying what’s known as “Lender’s Mortgage Insurance” (LMI). This protects the lender – not you, if you cannot repay your loan.

FINANCIAL SUPPORT FOR FIRST HOME BUYERS

You may be entitled to a range of government grants and concessions that vary according to which state or territory you are buying your home in. The First Home Owners Grant (FHOG) is the main source of financial support for first home buyers. It’s a one off, tax free payment to people buying their first home in Australia. State and territory governments hand out the FHOG on behalf of the Federal Government so it’s worth checking how it works in your area. The main conditions that determine eligibility for the FHOG in most – though not all, areas in Australia are set out below:

• You must be an Australian citizen or permanent resident buying or building your first home in Australia.

• The property you buy must be a recognised house or unit specifically designed for people to live in.

• You or your partner must not have purchased in Australia before.

• You must occupy the home for a period of at least 6months within 12months of settlement or building completion or where you apply after this time, subsequent to your application.

• Contracts must be exchanged between the buyer and seller before any cut-off dates.

For more up-to-date information, a Viking Home loan specialist can tell you about the perks you may be eligible for.

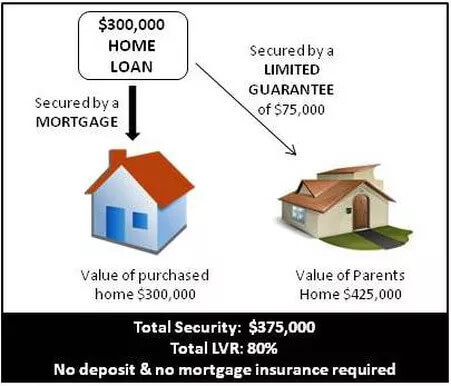

FAMILY GUARANTEE

This is where the bank takes security over a family member’s property. (Usually a parent) You would then have 2 loans one secured by the new property being purchased (The largest loan) and another secured by the parents’ home (usually about 20% of the purchase price plus costs).

Speak to your Viking Home Loan specialist to see if this is an option for you.

ORGANISING YOUR HOME LOAN

As a first home buyer, you probably plan to invest a great deal of time choosing the property that’s right for you. That’s a sensible approach as your home will also be a major investment.

It’s also worth spending time selecting the loan that is best suited to your needs. This will make it easier to live with your loan.

A Viking Home Loan specialist can help you choose the most suitable loan and the important steps you can take to increase your chance of securing loan approval.

LOAN PRE-APPROVAL

You don’t need to find a home before you can apply for a loan. In fact, there are good reasons to speak to a Viking Home Loan Specialist to get your loan sorted beforehand.

Most lenders provide a loan pre-approval which is usually subject to meeting required terms and conditions. This is where your loan limit is approved for a certain time (usually 3-6mths), and providing your circumstances haven’t changed you’ll know exactly how much you can afford to pay for a property, and you’ll have the freedom to make an offer on a property knowing that your finance is already organised.

You’ll have a better idea of what properties to look for, because you won’t waste time looking for something outside your price range, and once you find the right property, you’ll be able to focus on the purchase rather than having to sort out the finance at the same time.

With a pre-approved loan, there are fewer chances of hiccups with the sale process, and in some cases, the sellers will accept an offer below list price and take the property off the market with confidence knowing the buyer is serious. If you decide to make an offer, you’ll be in a position to move quickly if your finance is sorted.

CHOOSING THE RIGHT LOAN

There are hundreds of different loans out there in the mortgage marketplace. But fundamentally, they are all based on 2 key things:

• Principal – the amount of money you borrow

• Interest – how much you pay to borrow the money. It’s calculated on the outstanding principal

From here, there is a wide variety of loan features and structures to choose from, and it’s worth knowing what’s involved with each to make an informed decision.

VARIABLE LOANS

This is the most popular type of loan in Australia. The interest rate you pay may vary in line with movements in market interest rates, so you can expect the repayments to vary (up and down) over the course of the loan.

FIXED LOANS

With this type of loan the rate you pay- and the loan repayments, are fixed for a set period, usually between 1 – 5 years. This makes it easier to budget for repayments and you are protected from increases in the market interest rates. The downside is that if interest rates fall, you could end up paying more than necessary.

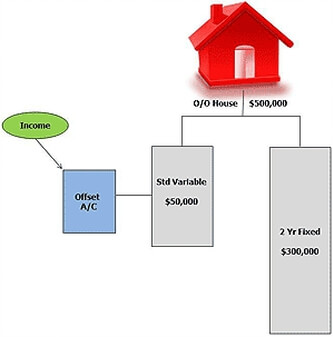

SPLIT LOANS

Many lenders will let you fix one part of your loan, while the remaining portion has a variable rate. This can give you the best of both worlds. With protection from rising interest rates though still with the ability to benefit from any rate cuts.

COSTS TO CONSIDER

In addition to your home buying deposit, your budget should allow for a number of other upfront and ongoing costs of owning a home.

BUYING COSTS

The process of buying a home involves a variety of costs. Some of these like stamp duty, are fixed by your state/territory government. Others, like legal fees, will vary according to the service provider you choose and shopping around to compare charges can help to trim the expense.

LENDER’S MORTGAGE INSURANCE

If your home loan is worth more than 80% of the purchase price, your lender will ask you to pay Lender’s Mortgage Insurance (LMI)

LMI is designed to protect the lender from home owners defaulting on their repayments, and where it applies, the LMI premium you may be asked to pay will usually vary according to the size of the loan, the type of property and the lender you choose. It is usually charged as a one-off premium and calculated on a sliding scale. Your lender will arrange LMI, it’s not something you can shop around for. Some lenders will allow you to capitalise it into the loan balance.

STAMP DUTY

Stamp duty is a tax you need to budget for when buying your home. It is levied on the purchase value of your home. Stamp duty is charged by the state and territory governments so the amount you pay will depend on where you buy the property. The good news is that in some states first home buyers may qualify for stamp duty concessions.

OTHER UPFRONT COSTS TO BUDGET FOR

When buying a property, there are other costs associated with the purchasing process. You’ll need to budget for:

• Pre-purchase Building and Pest reports

• A strata search (usually if you are buying an apartment)

• Conveyancing costs (legal fees)

• A loan application fee

• Insurances such as Mortgage Protection as well as Home and Contents Insurance

To get an accurate understanding of these costs, it’s a good idea to meet with a Viking Home Loan specialist early on. This way you’ll know what to expect early on and be able to budget accordingly.

HOW A MORTGAGE BROKER CAN HELP

A mortgage broker can be a very useful partner for a first home buyer. The broker will assess your financial situation, and match your requirements to a wide range of loans from banks and other financial institutions, managing the process right though to settlement.

There are good reasons to consider using a broker:

• The broker’s experience in the mortgage industry will help you make informed decisions and allow you to feel confident throughout the process

• A broker will search for a deal that meets your needs, from their panel of lenders. This provides access to a large range of loan options without you having to do any of the legwork

• A broker has access to loan rates as well as fees and charges at their fingertips so it’s easier to make a straightforward comparison of loan costs

• Brokers have a good relationship with lenders, and can often negotiate a very completive rate. Lenders receive a significant amount of business through the broker channel so it’s in their best interest to work closely with brokers

• The best news is that generally you won’t need to pay your broker. The broker receives an upfront commission from the lender on the loans they settle as well as a trailing commission.

Bear in mind that not all brokers have the same level of experience. It pays to look for a broker who is accredited with the Mortgage & Finance Association of Australia (MFAA) which sets professional standards and its members are required to adhere to a range of Code Practices, laws and regulation. Viking Mortgages Home loan specialists are MFAA accredited and diploma qualified.

PROPERTY CHECKLIST – WHAT TO CONSIDER/WHAT TO AVOID LOCATION YES NO

Do you want to be close to work? O O

Is reliable public transport available? O O

Is there construction going on in the area? O O

Which local amenities are important to you?

-

Shops O O

-

Parks, sporting grounds and other outdoor leisure facilities O

-

Hospitals/medical centers O O

-

Cafes/restaurants O O

-

Cinemas O O

-

Childcare/preschools/schools O O

PROPERTY

Would you prefer a house? O O

Are you interested in an apartment or townhouse? O O

Is off-street parking available? O O

Are you prepared to renovate? O O

Would you consider a two story home? O O

Is a modern kitchen important? O O

Do you want an en-suite bathroom? O O

Do you want a separate laundry? O O

How many bedrooms do you want?

-

One

-

Two

-

Three

-

Four

Do you want a large block or garden? O O

Would you like a swimming pool? O O

Would you prefer views? O O

CHECKLIST – COSTLY MISTAKES TO AVOID

Take a look at our list below to avoid falling into these traps:

Avoid changing jobs or making a major purchase at the same time as applying for home loan finance. It’s important that you appear as stable (and therefore as low risk) as possible in the eyes of a lender.

Failing to have home loan finance pre-approved, and leaving everything ‘too late’ when the ‘right’ property is found. It’s a competitive market for first home buyers and being able to move quickly once you have found a suitable property can be the key to securing the right place at a good price. If the home you want is for sale by auction, having loan pre-approval means avoiding the very real risk that you may not be able to arrange finance in time if you are the highest bidder – or worse, not being approved for a loan that covers the purchase value.

Borrowing right up to the amount the lender is prepared to loan you, and then getting over-stretched financially.

Letting emotions take over in the negotiation process, and paying too much for the property – or missing an opportunity to negotiate more favorable purchase conditions.

Not checking out things such as council zoning, building approvals and restrictive covenants. Your solicitor or conveyancer can do this on your behalf and it can mean avoiding a costly mistake buying a home that proves to be a disappointing purchase.

Buying a ‘do-up’ and then running out of money. Renovation is not a cast-iron route to riches, and if it turns out that it costs more than you bargained for, you could face incomplete renovations or find yourself under serious financial stress. If a property requires major renovation work, take a qualified builder you know and trust to inspect the place, and ask for a quote on the likely cost of work required to be completed.

Forgetting to sort out home insurance well before you move in, and neglecting to tell utility companies or other bodies such as your bank, superannuation fund and motor vehicle registration authority about your change of address.

WHY VIKING MORTGAGES?

When you’re ready to buy your first home, it’s a good idea to speak with a home loan expert.

A Viking Home Loan Specialist can make the whole experience easier, answer any questions you may have, and help you avoid any potentially costly mistakes.

A Viking Home Loan Specialist will compare hundreds of loans from a panel of lenders including the big banks, to find the deal that’s right for you.

Here’s how a Viking Home Loan Specialist can help you:

-

We take all the hard work out of the home loan process so you can spend more time finding the right property

-

We understand who is eligible for a first home owner grant and how to apply for one

-

We can come to you anywhere at any time that’s convenient to you

VIKING MORTGAGES BROKING SERVICE IS AT NO COST TO YOU.